Argomenti di tendenza

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

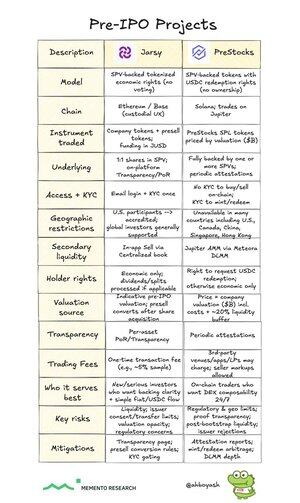

Pre-IPO Crypto Projects: When Private Markets Meet Permissionless Rails

Intro

Bullish on new frontiers such as biotech, space exploration or robotics but unsure how to get exposure? Or you’re dying to short @cluely because you think it’s just a marketing scam?

“Pre-IPO” is basically how investors can get exposure to a company before it lists on a public exchange (NASDAQ or NYSE).

Traditionally, only instis and UHNWIs could get access to this round via OTCs using specific fund vehicles. However all these come with high minimum amounts, tons of paperwork, and a very slow dealmaking process.

Meanwhile, most of the value creation in today’s modern tech companies now occurs while they remain private.

The result: retails are late to get exposure, and are often EL at the IPO.

This is where Pre-IPO crypto projects come by putting private-company exposure on open platforms: 24/7 markets, smaller tickets for individual investors with instant settlement.

So far there has been 2 approaches to this vertical:

• Backed-equity tokens (SPV model): where tokens represent economic rights to real shares held in a special-purpose vehicle (we focus more on this model in this piece)

• Synthetic markets (derivatives/perps): no underlying shares; users just trade a proxy for a company’s valuation and settlement is based on events/ oracle rules

- - - - -

Problems with the legacy setup

• Access: most need to be an accredited investor (AI) with high investment amounts - smaller investors are priced out. But change is brewing as the “Equal Opportunity for All Investors Act of 2025” just passed the House, directing the SEC to create a knowledge-based test. This could qualify investors based on market knowledge rather than just income or wealth, potentially opening pre-IPO deals to a much broader audience.

• Price discovery: IPO pricing can diverge sharply from true demand, retails often late to the party and used as EL (for example: @figma's IPO had a 4.3x day-one return, but the biggest gains went to early investors, now sitting on over $24B collectively. Source:

• Operational friction: transfers and settlements are often manual, and each country has a different jurisdiction regarding such investments (for example, access to U.S. private markets and pre-IPO opportunities is heavily limited in China/South East Asia, due to regulatory frameworks and investor restrictions)

Potential benefits of crypto rails

• Market structure: on-chain AMMs/order books create automated counterparties, you don’t need a pre-arranged buyer

• Fractional access: retails can invest as low as $10 for some products, makes it more accessible for the wider public

• Composability: like DeFi, such tokens could potentially be plugged into money markets or integrated in other structured products → finance legos...

Principali

Ranking

Preferiti